Latest Posts

-

Parking next to a crosswalk is now illegal

The law says you can't park within 20 feet of a crosswalk, whether it's marked or not.

-

DMV HIGHLIGHTS NEW LAWS IN 2023

DMV HIGHLIGHTS NEW LAWS IN 2023

-

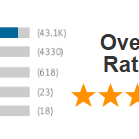

Why Over 43,000 Drivers Have Given Traffic School 4 Busy People a 5-Star Rating

Why Over 43,000 Drivers Have Given Traffic School 4 Busy People a 5-Star Rating

-

HOW DOES A SPEEDING TICKET AFFECT YOUR CAR INSURANCE RATES?

HOW DOES A SPEEDING TICKET AFFECT YOUR CAR INSURANCE RATES?

-

LIST: NEW CALIFORNIA TRAFFIC SAFETY LAWS FOR 2022

LIST: NEW CALIFORNIA TRAFFIC SAFETY LAWS FOR 2022

-

Bay Area drivers say traffic ticket lawyer took money, skipped court

Bay Area drivers say traffic ticket lawyer took money, skipped court

-

California drivers face new laws in 2021

California drivers face new laws in 2021

-

What's the Difference Between a Traffic School and a Defensive Driving School?

What's the Difference Between a Traffic School and a Defensive Driving School? Driving is a privilege that comes with great responsibility. But even the most careful drivers can make mistakes, which is why traffic schools and defensive driving schools exist.

-

How Does a Speeding Ticket Affect Your Car Insurance Rates?

Getting a speeding ticket is not only an unwelcome expense, but it can also have long-lasting consequences for your car insurance rates. In this blog post, we'll explore how a speeding ticket can impact your insurance premiums and provide some insights into what you can do to mitigate its effects.

-

Frequently Asked Questions About Online Traffic School in California

Frequently Asked Questions About Online Traffic School in California

-

Traffic School 4 Busy People: The Best Online Traffic School in California

When it comes to online traffic schools in California, Traffic School 4 Busy People stands out as the top choice for countless drivers. With an impressive track record of assisting over 280,000 drivers in maintaining clean driving records and earning more than 33,000 Five-Star Customer reviews, we have gained a reputation for excellence. In this blog post, we will delve into the reasons why Traffic School 4 Busy People is considered the best online traffic school in California.

-

Traffic School 4 Busy People: The Quickest Online Traffic School in California

When time is of the essence, Traffic School 4 Busy People emerges as the ultimate choice for completing your online traffic school requirements in California. With its legally allowed shortest course duration, absence of timers, two chances to pass the final test, lenient passing criteria, and free unlimited course retakes, this traffic school prioritizes your convenience and success. Join the thousands of drivers who have chosen Traffic School 4 Busy People and experience the quickest way to complete your traffic school course.

-

Traffic School 4 Busy People: The Easiest Online Traffic School in California

Completing a traffic school course can often be a stressful task, but it doesn't have to be. Traffic School 4 Busy People understands the importance of making it easy to take and pass traffic school. This blog post highlights the reasons why Traffic School 4 Busy People is considered the easiest online traffic school in California.

-

What Is A Driver Safety Course?

What is a Driver Safety Course? As driving is an integral part of our daily lives, ensuring road safety is paramount. A driver safety course is a valuable educational program designed to equip drivers with essential knowledge and skills to navigate the roads responsibly. In this blog post, we will explore the concept of driver safety courses, focusing on two exceptional online courses: Traffic School 4 Busy People and Mature Driver Tune-Up, both designed to cater to different driving needs.

-

Why You Should Take Traffic School After Getting a Ticket in California

Getting a traffic ticket in California is frustrating—but it doesn’t have to cost you for years. If you’re eligible, taking traffic school can save you money, protect your driving record, and give you peace of mind.

-

What to Do After You Receive a Traffic Ticket in California

What to Do After You Receive a Traffic Ticket in California. Here’s exactly what to do after you receive a ticket—and why traffic school is often the smartest choice.

-

Top 10 Questions Drivers Ask About California Traffic School (2026 Guide)

This guide answers the top 10 questions drivers ask about taking California traffic school, including online courses, eligibility, and deadlines.

-

What Happens After You Get a Traffic Ticket in California? (Step-by-Step Guide)

Here’s a clear, step-by-step breakdown of what happens after you receive a traffic ticket in California and what you should do next.

-

Can You Take Traffic School After Paying Your Ticket in California?

Can You Take Traffic School After Paying Your Ticket in California?

-

How Long Does Online Traffic School Take in California?

How Long Does Online Traffic School Take in California?

-

How Often Can You Take Traffic School in California?

How Often Can You Take Traffic School in California? California drivers may take traffic school once every 18 months. Violations outside this period are ineligible.

-

Is Online Traffic School Legit in California?

Is Online Traffic School Legit in California? Online traffic school is fully legal if it is California DMV-licensed and accepted by all California courts. Courts treat online and in-person traffic school the same.

-

Speeding Ticket in California: What Are Your Options?

Speeding Ticket in California: What Are Your Options? After a speeding ticket, you can: Pay the fine (point goes on record). Contest the ticket. Take traffic school (prevents point).

-

Does Traffic School Remove the Ticket in California?

Does Traffic School Remove the Ticket in California? Traffic school does not remove the ticket, but it prevents the point from being visible on your public record.

-

What Happens If You Miss the Traffic School Deadline?

What Happens If You Miss the Traffic School Deadline? If you miss the traffic school deadline: A point is added to your record. Possible insurance increases. Court may not allow a second chance. If it is close to your deadline, contact the court. They might give you an extension.

-

Traffic School vs Paying the Ticket: What’s Better?

Traffic School vs Paying the Ticket: What’s Better? Paying is faster, but the point stays on your record. Traffic school prevents points from showing publicly, protecting insurance rates and only takes a few hours vs. paying hundreds of dollars in increased premiums over three years.

-

Can You Take Traffic School on Your Phone?

Can You Take Traffic School on Your Phone? Online traffic school is fully mobile-friendly: Access on phone, tablet, or laptop.

-

Fastest Traffic School in California: What Drivers Should Know

Fastest Traffic School in California: What Drivers Should Know

-

Complete Guide to California Traffic School for Busy Drivers

If you received a traffic ticket in California, you have options. Traffic school can help you avoid points and protect your insurance. Here’s a complete guide:

-

How Long Do Points Stay on Your Driving Record in California?

If you receive a traffic ticket in California, points may be added to your driving record. These points can affect your insurance rates and, if they add up, even your license status. Knowing how long points stay on your record — and how to reduce their impact — can save you money and stress.

-

The Real Cost of a Traffic Ticket in California

The Real Cost of a Traffic Ticket in California.

-

Contesting a Traffic Ticket vs. Going to Traffic School in California: Costs, Benefits & Smart Choices

Contesting a Traffic Ticket vs. Going to Traffic School in California: Costs, Benefits & Smart Choices

All Posts

Photostream

Social

How Does a Speeding Ticket Affect Your Car Insurance Rates?

We've all been there—a momentary lapse in judgment, a heavy foot on the gas pedal, and the flashing lights of a police car in our rearview mirror. Getting a speeding ticket is not only an unwelcome expense, but it can also have long-lasting consequences for your car insurance rates. In this blog post, we'll explore how a speeding ticket can impact your insurance premiums and provide some insights into what you can do to mitigate its effects.

-

Increased Premiums: One of the immediate impacts of receiving a speeding ticket is the potential increase in your car insurance premiums. Insurance companies view speeding tickets as red flags that indicate an increased risk of accidents. Consequently, they may adjust your rates to reflect this higher perceived risk. The extent of the rate increase can vary depending on factors such as the severity of the violation, your driving history, and the specific insurance provider.

-

Loss of Good Driver Discounts: If you had been enjoying the benefits of a good driver discount due to a clean driving record, a speeding ticket could cause you to lose that discount. Good driver discounts are often offered to individuals who have maintained a clean driving history without any violations or accidents. However, a speeding ticket can nullify these discounts, resulting in a notable increase in your premiums.

-

Points on Your Driving Record: In addition to the financial implications, receiving a speeding ticket also means accumulating points on your driving record. Different jurisdictions have varying point systems, but generally, the more severe the violation, the more points you accumulate. Insurance companies often consider these points as a reflection of your driving habits and risk profile, which can lead to higher premiums. Accumulating too many points within a specific time frame may even result in license suspension or other penalties.

-

Potential Loss of Coverage or Policy Cancellation: In some cases, a speeding ticket may trigger your insurance provider to reconsider your coverage altogether. If you have a history of multiple violations or engage in reckless driving, your insurer may deem you a high-risk driver. This could result in non-renewal of your policy, requiring you to seek coverage from another provider who may charge significantly higher rates. It is essential to maintain a responsible driving record to avoid such consequences.

-

Mitigating the Effects: While the impact of a speeding ticket on your insurance rates is largely unavoidable, there are steps you can take to mitigate its effects:

a. Attend Traffic School: Some jurisdictions allow drivers to attend traffic school in exchange for reducing or eliminating the points associated with a speeding ticket. This can help minimize the long-term impact on your driving record and potentially lessen the rate increase.

b. Shop for Insurance: If your rates increase significantly after receiving a speeding ticket, consider shopping around for new insurance providers. Different companies have different underwriting guidelines and may offer more favorable rates despite your violation.

c. Focus on Safe Driving: The best way to mitigate the effects of a speeding ticket is to maintain a clean driving record moving forward. Avoiding further violations and practicing safe driving habits can help rebuild trust with your insurance provider over time.

Conclusion: Receiving a speeding ticket can have a noticeable impact on your car insurance rates. From increased premiums to the loss of discounts and potential policy cancellations, the consequences can be far-reaching. To minimize the effects, it is crucial to take proactive steps such as attending traffic school, shopping for insurance, and prioritizing safe driving. Remember, responsible driving not only keep you and others safe on the road but also helps you maintain affordable car insurance rates in the long run.